Don't Let Foreclosure Drag You Down

Discover Your Options Now

What do we do?

Foreclosure is a difficult and stressful situation that can be caused by various reasons such as job loss, medical emergencies or financial mismanagement. However, there are ways to avoid it. We guide you with skill and compassion to a place of FREEDOM

How do we do it?

Lenders often have programs in place to help struggling homeowners avoid foreclosure. You may also consider selling your property rather than waiting for your lender to initiate foreclosure. Either way, seek help from people knowledgeable about the foreclosure process who will help you find a solution that works for you. We never ask you for a single cent.

Lender Negotiations

Introduction:

Foreclosure is a legal process in which a lender takes possession of a property when the borrower has failed to make mortgage payments. Foreclosure can have a devastating impact on homeowners, including the loss of their property, damage to their credit score, and a decrease in local property values. To avoid foreclosure, it's important for homeowners to understand the importance of negotiating with their lender.

One of the first steps in avoiding foreclosure is to reach out to the lender as soon as possible. Many lenders are willing to work with homeowners who are facing financial difficulties and are struggling to make their mortgage payments. By reaching out to the lender early on, homeowners can start the conversation about potential solutions to their financial difficulties.

Things to Think About:

When negotiating with a lender, it's important for homeowners to be prepared and to have a clear understanding of their financial situation. This includes information about their income, expenses, and any assets they have that could be used to help resolve the situation. Homeowners should also have a clear understanding of their loan terms, including the interest rate, monthly payment, and loan balance.

In negotiating with the lender, homeowners should be proactive and open about their financial situation. This includes providing the lender with documentation that supports their financial hardship and explaining what steps they are taking to resolve their financial difficulties. Homeowners should also be prepared to discuss potential solutions to their financial difficulties, including loan modification, loan forbearance, or a payment plan.

Loan modification is a process in which a lender agrees to alter the terms of an existing loan to make it more affordable for the borrower. This can involve reducing the interest rate, extending the loan term, or adjusting the monthly payment amount. Loan modification is often used as a solution for homeowners who are facing financial difficulties and are at risk of losing their homes to foreclosure.

Loan forbearance is a temporary solution that allows a borrower to temporarily stop making mortgage payments or to make reduced payments. The purpose of loan forbearance is to give the borrower time to get back on their feet and get back to making their full mortgage payments. Loan forbearance is typically offered to borrowers who have experienced a temporary financial hardship, such as job loss, illness, or a reduction in income.

In negotiating with the lender, homeowners should also be aware of their rights and the laws that protect them. The Homeowners' Bill of Rights, for example, is a set of laws that protect homeowners from certain practices by mortgage servicers, including dual-tracking (the simultaneous pursuit of foreclosure while a loan modification is being considered), wrongful foreclosure, and illegal foreclosure-related evictions. Homeowners should be familiar with their rights under these laws and be prepared to assert them if necessary.

Another important consideration in negotiating with a lender is the impact of foreclosure on the lender. Foreclosure is a costly and time-consuming process for lenders, and they may be willing to work with homeowners to avoid this outcome. Homeowners should be aware of the costs associated with foreclosure, including legal fees, marketing and advertising expenses, and the costs of managing and maintaining the property while it is unoccupied.

In conclusion, negotiating with your lender is an important step in avoiding foreclosure. By reaching out to the lender early on, being prepared and proactive, and understanding your rights and the impact of foreclosure on the lender, homeowners can increase their chances of successfully avoiding foreclosure and keeping their homes. Homeowners facing financial difficulties should work with their lender to explore all possible solutions and determine the best course of action for their individual situation.

Who We Are

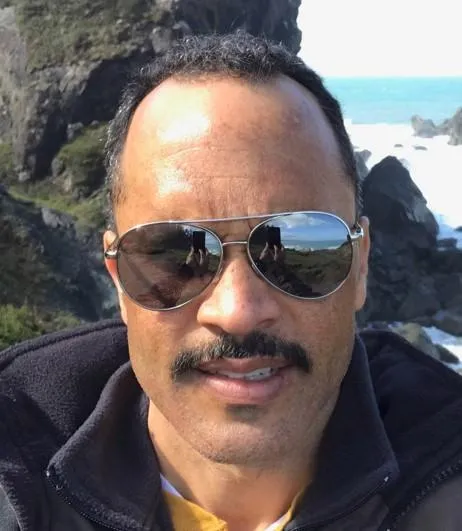

Meet Martin Turner, a new but driven real estate investor with a passion for helping people avoid foreclosure. With a strong background in construction management and a deep understanding of the industry, Martin is dedicated to finding creative solutions to help homeowners keep their homes. He is committed to using expertise to make a positive impact in the lives of those facing financial difficulties.

Martin Turner

Real Estate Investor

Testimonials

The Foreclosure Cancellation program is fantastic. We were able to restructure our loan and avoid foreclosure

-Nicolas

Call 530.444.8231

Email:mturner@reflectionprop.com

REFLECTION PROPERTIES LLC. ALL Right Reserved. Copyright 2022.