Don't Let Foreclosure Drag You Down

Discover Your Options Now

What do we do?

Foreclosure is a difficult and stressful situation that can be caused by various reasons such as job loss, medical emergencies or financial mismanagement. However, there are ways to avoid it. We guide you with skill and compassion to a place of FREEDOM

How do we do it?

Lenders often have programs in place to help struggling homeowners avoid foreclosure. You may also consider selling your property rather than waiting for your lender to initiate foreclosure. Either way, seek help from people knowledgeable about the foreclosure process who will help you find a solution that works for you. We never ask you for a single cent.

Loan Forebearance

Introduction:

Loan forbearance and loan modification are both solutions for homeowners who are facing financial difficulties and are struggling to make their mortgage payments. While both options can help homeowners avoid foreclosure, they are different in their approach and the impact they have on the borrower's loan. In this article, we'll discuss what loan forbearance and loan modification are, how they work, and the differences between the two.

How it Can Help

Loan forbearance is a temporary solution that allows a borrower to temporarily stop making mortgage payments or to make reduced payments. The purpose of loan forbearance is to give the borrower time to get back on their feet and get back to making their full mortgage payments. Loan forbearance is typically offered to borrowers who have experienced a temporary financial hardship, such as job loss, illness, or a reduction in income.

In a loan forbearance agreement, the lender agrees to allow the borrower to temporarily stop making payments or to make reduced payments for a specified period of time. At the end of the forbearance period, the borrower will be expected to resume making full mortgage payments, which may include a lump sum payment to catch up on missed payments.

Loan modification, on the other hand, is a permanent solution that involves changing the terms of the loan to make it more affordable for the borrower. This can involve reducing the interest rate, extending the loan term, or adjusting the monthly payment amount. The goal of loan modification is to help the borrower avoid foreclosure and keep their home by making their mortgage payments more affordable in the long term.

To be eligible for a loan modification, the borrower must demonstrate that they are facing a financial hardship and are unable to make their mortgage payments. The lender will consider the borrower's financial situation and their ability to make future payments before deciding whether to approve the loan modification. If approved, the borrower will typically enter into a trial period where they make modified payments for several months. If the borrower successfully makes these payments, the loan modification will become permanent.

One of the key differences between loan forbearance and loan modification is the length of the solution. Loan forbearance is a temporary solution that allows the borrower to temporarily stop making payments or to make reduced payments for a specified period of time. Loan modification, on the other hand, is a permanent solution that changes the terms of the loan to make it more affordable in the long term.

Another difference is the impact on the loan balance. In a loan forbearance agreement, missed payments are typically added to the end of the loan term, increasing the overall balance of the loan. In a loan modification, the terms of the loan are changed to make it more affordable, which may result in a reduction of the loan balance.

In terms of the impact on the borrower's credit score, loan forbearance and loan modification can both have a negative impact. Missing mortgage payments can hurt a borrower's credit score, regardless of whether they are in a forbearance or modification agreement. However, loan modification can have a less severe impact on the credit score than foreclosure, as it demonstrates that the borrower is actively working with the lender to resolve their financial difficulties.

In conclusion, loan forbearance and loan modification are both solutions for homeowners facing financial difficulties and struggling to make their mortgage payments. Loan forbearance is a temporary solution that allows the borrower to temporarily stop making payments or to make reduced payments for a specified period of time. Loan modification is a permanent solution that involves changing the terms of the loan to make it more affordable for the borrower in the long term. Homeowners should carefully consider their options and work with their lender to determine the best solution for their individual situation.

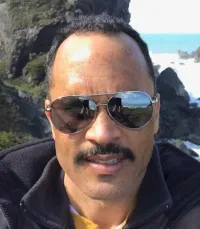

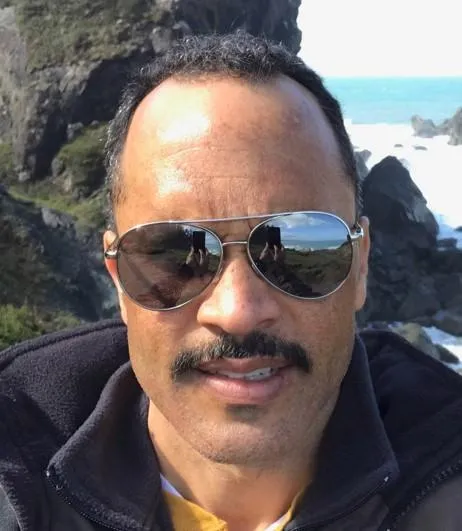

Who We Are

Meet Martin Turner, a new but driven real estate investor with a passion for helping people avoid foreclosure. With a strong background in construction management and a deep understanding of the industry, Martin is dedicated to finding creative solutions to help homeowners keep their homes. He is committed to using expertise to make a positive impact in the lives of those facing financial difficulties.

Martin Turner

Real Estate Investor

Testimonials

The Foreclosure Cancellation program is fantastic. We were able to restructure our loan and avoid foreclosure

-Nicolas

Call 530.444.8231

Email:mturner@reflectionprop.com

REFLECTION PROPERTIES LLC. ALL Right Reserved. Copyright 2022.