Don't Let Foreclosure Drag You Down

Discover Your Options Now

What do we do?

Foreclosure is a difficult and stressful situation that can be caused by various reasons such as job loss, medical emergencies or financial mismanagement. However, there are ways to avoid it. We guide you with skill and compassion to a place of FREEDOM

How do we do it?

Lenders often have programs in place to help struggling homeowners avoid foreclosure. You may also consider selling your property rather than waiting for your lender to initiate foreclosure. Either way, seek help from people knowledgeable about the foreclosure process who will help you find a solution that works for you. We never ask you for a single cent.

Loan Modification

Introduction:

Loan modification is a process by which a lender agrees to change the terms of an existing loan to make it more affordable for the borrower. This can involve reducing the interest rate, extending the loan term, or adjusting the monthly payment amount. Loan modification is often used as a solution for homeowners facing financial hardship and at risk of losing their homes to foreclosure. In this article, we'll discuss what loan modification is, how it works, and why it can help prevent foreclosure.

Foreclosure is a legal process that allows a lender to take possession of a property when the borrower has failed to make mortgage payments. It can be a long, complicated, and stressful process that can result in the homeowner losing their property and damaging their credit score. Foreclosure can also have a significant impact on the local housing market, causing property values to decline and affecting the community as a whole.

Loan modification is designed to help homeowners who are facing financial hardship and are at risk of foreclosure. It works by changing the terms of the loan to make it more affordable for the borrower. This can involve reducing the interest rate, extending the loan term, or adjusting the monthly payment amount. The goal of loan modification is to help the borrower avoid foreclosure and keep their home.

How Loan Modification Works:

To be eligible for a loan modification, the homeowner must demonstrate that they are experiencing financial hardship and are unable to make their mortgage payments. This can be due to a variety of factors, including job loss, medical expenses, or a reduction in income. The lender will consider the borrower's financial situation and their ability to make future payments before deciding whether to approve the loan modification.

Once the borrower has been approved for a loan modification, they will typically enter into a trial period where they make modified payments for several months. If the borrower successfully makes these payments, the loan modification will be made permanent. The terms of the loan modification will be set in writing, and the borrower will be expected to adhere to these terms going forward.

Loan modification can be beneficial for both the borrower and the lender. For the borrower, it can help them avoid foreclosure and keep their home. It can also reduce their monthly payment and make it easier for them to manage their debt. For the lender, loan modification can help them avoid the costly and time-consuming process of foreclosure, as well as the potential loss of the property.

There are several different types of loan modification programs available to homeowners, each with its own eligibility requirements and benefits. Some of the most common types of loan modification programs include:

1. Home Affordable Modification Program (HAMP) - This program was created by the federal government to help struggling homeowners avoid foreclosure. It provides eligible borrowers with a reduced monthly payment and a lower interest rate.

2. FHA Loan Modification - This program is available to borrowers with FHA-insured mortgages who are facing financial hardship. It can provide eligible borrowers with a reduced monthly payment and a lower interest rate.

3. VA Loan Modification - This program is available to veterans and military service members who are facing financial hardship and are at risk of foreclosure. It can provide eligible borrowers with a reduced monthly payment and a lower interest rate.

4. In-House Loan Modification - This type of loan modification is offered directly by the lender. It is tailored to the specific needs of the borrower and may include reducing the interest rate, extending the loan term, or adjusting the monthly payment amount.

In conclusion, loan modification is a valuable tool for homeowners facing financial hardship and at risk of losing their homes to foreclosure. It works by changing the terms of the loan to make it more affordable for the borrower, reducing their monthly payment and helping them keep their home. There are several different types of loan modification tactics. Experienced professionals can guide you through this process. By working with a lender and exploring the different loan modification programs available, homeowners can take control of their financial situation and keep their homes.

Who We Are

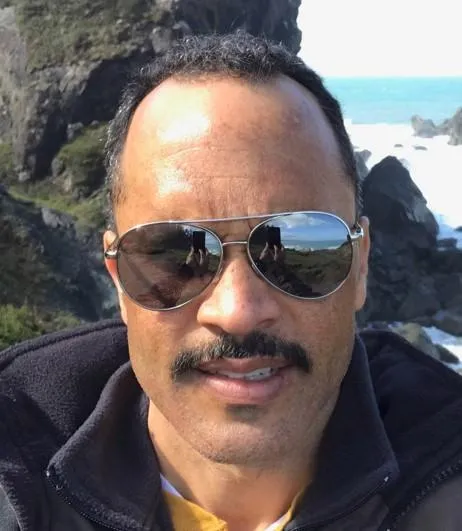

Meet Martin Turner, a new but driven real estate investor with a passion for helping people avoid foreclosure. With a strong background in construction management and a deep understanding of the industry, Martin is dedicated to finding creative solutions to help homeowners keep their homes. He is committed to using expertise to make a positive impact in the lives of those facing financial difficulties.

Martin Turner

Real Estate Investor

Testimonials

The Foreclosure Cancellation program is fantastic. We were able to restructure our loan and avoid foreclosure

-Nicolas

Call 530.444.8231

Email:mturner@reflectionprop.com

REFLECTION PROPERTIES LLC. ALL Right Reserved. Copyright 2022.